The gold and silver market in 2026 is drawing steady attention as prices stabilise near important levels following the strong advances of last year. While both metals have already delivered notable gains, the way prices are behaving now suggests consolidation rather than exhaustion. Instead of sharp reversals or panic-driven selling, gold and silver are holding firm at higher ranges, pointing to continued structural support rather than a completed cycle.

This stability is not accidental or purely technical. A range of long-term forces is aligning beneath the surface, quietly shaping demand and limiting downside pressure. Central bank behaviour, real interest rate dynamics, industrial demand trends, and broader economic uncertainty are all reinforcing the role of precious metals within diversified portfolios. Together, these factors create an environment where prices can remain supported even during periods of consolidation.

Understanding these forces helps investors move beyond short-term price fluctuations and focus on the bigger picture. Rather than signalling an end, the current phase may represent a pause within a broader trend.

Below are seven key reasons why gold and silver prices may continue to rise further in 2026.

1-Central Bank Accumulation Has Redefined Gold’s Price Behaviour

One of the most decisive changes in the gold market over recent years has come from central banks. For a long time, gold was viewed by official institutions as a legacy holding rather than an active strategic asset. That perception has clearly shifted, and it has altered how gold behaves across market cycles.

- Central banks are now building gold reserves in a steady and deliberate manner, rather than reacting to short-term price movements. This accumulation reflects a long-term adjustment in reserve strategy, not a tactical response to market volatility or geopolitical headlines.

- Many countries are intentionally reducing their reliance on foreign currencies and increasing exposure to assets that carry no counterparty risk. Gold fits this requirement because it does not depend on another country’s fiscal discipline, political stability, or monetary policy framework.

- This sustained institutional buying creates a structural demand layer beneath the gold market. During periods of price weakness, large buyers tend to absorb supply, which limits sharp sell-offs and reduces the probability of prolonged drawdowns.

- For private investors, this evolution changes gold’s role within portfolios. It increasingly behaves as a reserve-grade monetary asset with long-term relevance, rather than a short-term hedge used only during moments of crisis or extreme uncertainty.

2-Real Interest Rates Remain a Core Tailwind

Gold’s long-term performance has consistently been influenced more by real interest rates than by nominal rate levels. What matters most is whether returns on cash and bonds meaningfully exceed inflation over time.

- As 2026 approaches, real yields remain constrained because central banks face structural limitations. Raising rates aggressively risks slowing economic growth, destabilising housing markets, and sharply increasing debt servicing costs for governments and consumers.

- At the same time, keeping policy rates too low gradually erodes currency purchasing power. This creates a persistent policy trade-off where neither tightening nor easing delivers strong inflation-adjusted returns for savers.

- This extended balancing act tends to suppress real yields for long periods, which reduces the opportunity cost of holding non-yielding assets like gold. When traditional income instruments struggle to protect purchasing power, gold becomes more competitive by comparison.

- Silver responds to the same macro environment but with greater sensitivity. Its smaller market size and hybrid role as both an industrial and monetary metal amplify price movements when capital flows into precious metals, resulting in stronger rallies and sharper corrections.

3-Silver’s Volatility Signals Opportunity, Not Exhaustion

Silver’s price behaviour through 2025 and into early 2026 shows that volatility is a built-in feature of the market, not a sign that the trend is ending. After years of underperforming gold, silver delivered strong gains as industrial demand, macro conditions, and investor interest aligned. The recent move highlights both strength and natural price swings.

- Past underperformance created room for a sharp rebound. Silver entered 2025 at relatively low levels compared to gold. When conditions turned supportive, prices adjusted quickly, consistent with earlier cycles where silver catches up rapidly after long gaps.

- Prices reached historic levels during the rebound. In late 2025, silver traded in record territory, at times moving above the $70–$80 per ounce range globally, making it one of the strongest-performing major commodities.

- Volatility increased but followed a familiar pattern. Sharp intraday declines were often followed by fast recoveries, including sessions where losses were quickly reversed. These swings reflected sensitivity to economic data, investor positioning, and technical flows rather than panic selling.

- Relative valuation still does not signal a peak. Even after strong gains, silver’s valuation compared with gold remains below levels typically seen at major market tops, suggesting the move reflects structural support rather than excess speculation.

Silver’s dual role as an industrial metal and a monetary hedge naturally amplifies price movements. For investors, the key is discipline. Careful position sizing and a long-term approach help manage short-term swings while staying positioned for silver’s potential upside.

4-Industrial Demand Is Quietly Transforming the Silver Market

Silver is different from gold in one important way. Gold is mostly stored and held for value, while silver is used. It works both as an investment metal and as a key material in many industries. This dual role is creating growing pressure on supply.

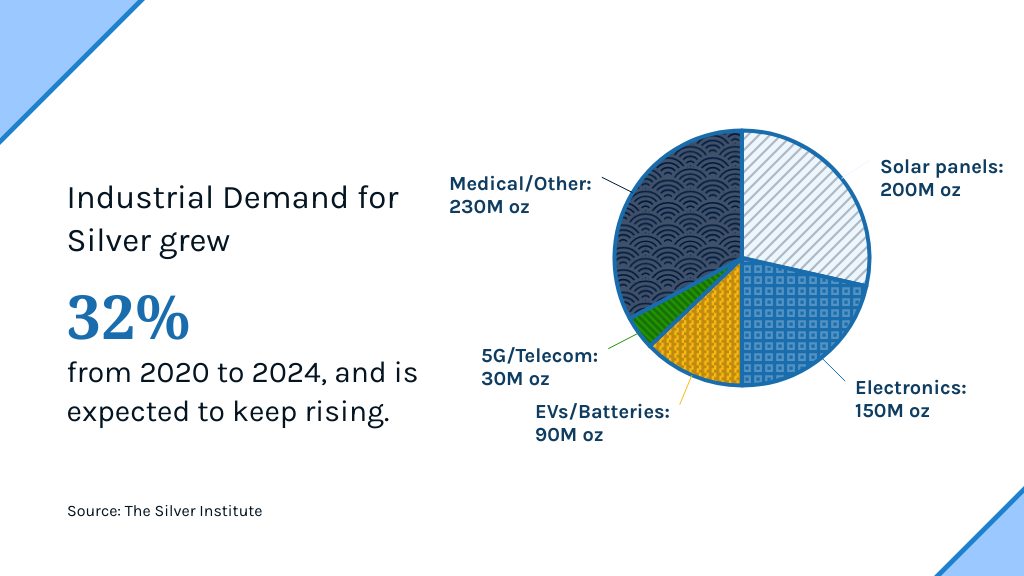

- Clean energy and modern technology are driving much of this demand. Solar panels rely on silver for efficiency, electric vehicles use it in electronics and charging systems, and it is essential for 5G networks, medical equipment, and everyday electronics. Silver’s ability to conduct electricity better than any other metal makes it hard to replace.

- Industrial demand has risen quickly over the past few years. Industry estimates show that silver use by manufacturers has grown sharply since 2020 and continues to increase as renewable energy and technology adoption expand.

- A crucial point is that industrial silver rarely comes back into the market. Once silver is built into solar panels, electronics, or medical devices, it is usually lost permanently. This is very different from investment silver, which can be sold back into the market when prices rise.

- Supply has not kept up with this pace. Mine production has remained relatively stable, while total demand continues to grow. The gap is being filled by recycling and existing stockpiles, but those sources are limited.

Over time, when demand keeps rising and supply struggles to respond, prices tend to adjust upward. This growing imbalance helps explain why silver remains under long-term pressure despite short-term price swings.

5-Geopolitical Risk Has Become Structural, Not Cyclical

Gold and silver tend to benefit most when uncertainty becomes a long-lasting feature of the global system rather than a series of isolated events. In recent years, geopolitical risk has moved beyond short bursts of tension and is shaping investor behaviour and commodity pricing in a more persistent way.

- Shifting global alliances and persistent geopolitical tensions are creating an environment where uncertainty is structural. For example, recent developments surrounding the U.S. operation against Venezuela’s president Nicolás Maduro in early January 2026 sparked a notable surge in gold and silver prices, with gold rising over 2% and silver climbing close to 4% as investors sought safe-haven assets amid fears of broader geopolitical escalation.

- Trade relationships are being reconfigured, often due to geopolitical friction rather than normal economic evolution. Ongoing competition between major powers has sustained trade tensions and contributed to a repricing of risk across markets. Gold and silver have responded accordingly, extending rallies to fresh highs as uncertainty persists.

- Defence and security spending are on the rise across multiple regions, reflecting long-term strategic competition rather than short-term crisis responses. These spending trends underscore the broader shift toward a global environment where policy unpredictability and power competition are now baseline conditions.

- Political fragmentation and strategic competition within and between major economies have reduced confidence in established multilateral systems. This has weakened traditional hedges like government bonds in certain scenarios, pushing investors toward assets that do not depend on political outcomes or institutional trust.

- In such an environment, gold and silver gain structural appeal because they cannot be altered, frozen, or devalued by a single government decision. Their independence from political systems helps sustain demand even in the absence of headline crises, making them reliable hedges against enduring geopolitical risk.

6-Currency Confidence Is Eroding Gradually

Rising debt levels across major economies are placing long-term pressure on currencies. While immediate crises are unlikely, gradual erosion of purchasing power remains a realistic outcome.

Historically, periods of sustained monetary expansion favour hard assets. Gold and silver have preserved purchasing power across decades and economic regimes.

Investors do not need to expect collapse to justify exposure. They only need to recognise that currency dilution tends to occur slowly and persistently. Precious metals serve as long-term anchors in this process.

7-Technical Structure Supports Continuation

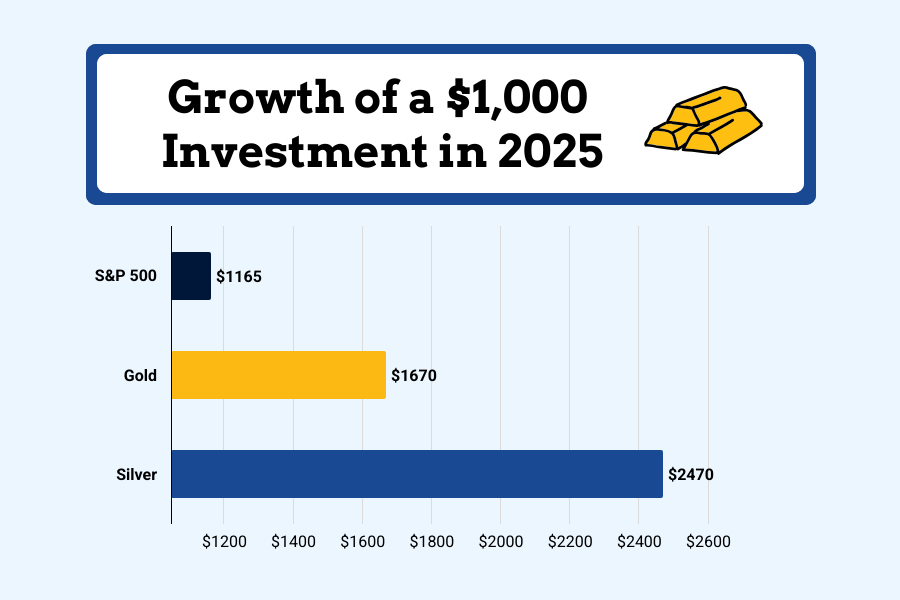

From a technical analysis perspective, the price action seen in 2025 confirmed what long-term chart structures had been signalling for years. Gold rose roughly 67% during the year, while silver surged by about 147%. These were not ordinary advances. They were the type of moves that typically mark the start of broader bull market phases.

- The scale of the breakout is significant. Gold’s move from the $2,600–$2,700 region to above $4,400 represented a clear breakout of long-standing consolidation ranges. Since then, prices have held near the $4,200–$4,400 zone, suggesting the market is absorbing gains rather than reversing direction.

- Silver’s sharp rise reinforces this technical picture. Historically, silver tends to outperform gold once a precious metals cycle gains momentum. The 147% rally aligns with this pattern and reflects silver’s leverage when monetary conditions, industrial demand, and risk sentiment align.

- Both metals are now trading in price discovery zones where historical resistance is limited. In such environments, trends often develop in stages rather than ending abruptly after the first breakout.

- Volume behaviour during pullbacks adds confidence to this structure. Declines have generally been met with buying interest rather than sustained selling, pointing toward institutional participation rather than short-term speculation.

Historical context supports this view. During the 2010–2011 cycle, gold gained around 80% over 18 months, while silver more than tripled, with multiple corrections along the way. If current conditions remain supportive, the 2025 rally may represent an early phase rather than the final move.

That said, disciplined risk management remains essential. Partial profit-taking, gradual entries on pullbacks, and defined risk limits help investors participate without chasing extended prices.

Analyst and Market Consensus Snapshot

Most market experts believe gold and silver remain well supported as 2026 approaches. Their views are based on long-term factors rather than short-term price movements.

- Analysts note that steady buying by central banks continues to support gold prices. This ongoing demand helps limit sharp declines during market pullbacks.

- Low real interest rates are another key reason for optimism. When inflation-adjusted returns on cash and bonds remain weak, gold and silver become more attractive as stores of value.

- In the case of silver, experts highlight ongoing supply shortages caused by rising industrial demand and limited production growth. This imbalance is expected to support prices over time.

- Geopolitical uncertainty also plays a role. Ongoing global tensions and political instability continue to increase demand for safe-haven assets like gold and silver.

- While price swings are expected, analysts generally view these moves as normal market corrections rather than signs of weakness.

Overall, the common view is that gold and silver may experience ups and downs, but the main factors supporting them remain strong heading into 2026.

Final Perspective

Gold and silver heading into 2026 are supported by a convergence of long-term forces rather than short-term speculation. Monetary constraints, industrial demand growth, geopolitical uncertainty, and shifting attitudes toward currency stability are reinforcing one another.

Markets rarely reward perfect timing. They tend to reward preparation, patience, and discipline. For traders and investors focused on resilience, diversification, and long-term purchasing power, precious metals remain strategically relevant as the global financial landscape continues to evolve.

source of image : goldsilve.com

Read here to learn more about Trump Energy Policy : Dollar Power and Gold’s Next Big Run?

I’m Chaitali Sethi, a financial writer and market strategist focused on Forex trading, market behaviour, and trader psychology. I simplify complex market movements into clear, practical insights that help traders make better decisions and build a stronger trading mindset.