The Stochastic Oscillator is one of the most recognized technical tools in forex trading. Unlike simple price-following indicators, this oscillator measures momentum by comparing the closing price of a currency pair to its price range over a given period. Since momentum often shifts before price does, the Stochastic Oscillator gives traders a chance to anticipate changes in direction. By focusing on relative position rather than absolute value, the indicator highlights when markets are stretched and vulnerable to corrections.

Traders use the Stochastic Oscillator because it consistently identifies areas of exhaustion in the market. When price closes near the top of its range, the indicator suggests strong buying pressure. Conversely, when price settles near the bottom of its range, selling pressure dominates. This simple yet powerful interpretation makes it one of the most effective ways to track market psychology. Knowing how to use Stochastic Oscillator properly ensures traders can manage entries, exits, and risk with greater confidence. Most importantly, when used with other signals, the Stochastic Oscillator helps create a strong trading strategy that works well in different forex situations.

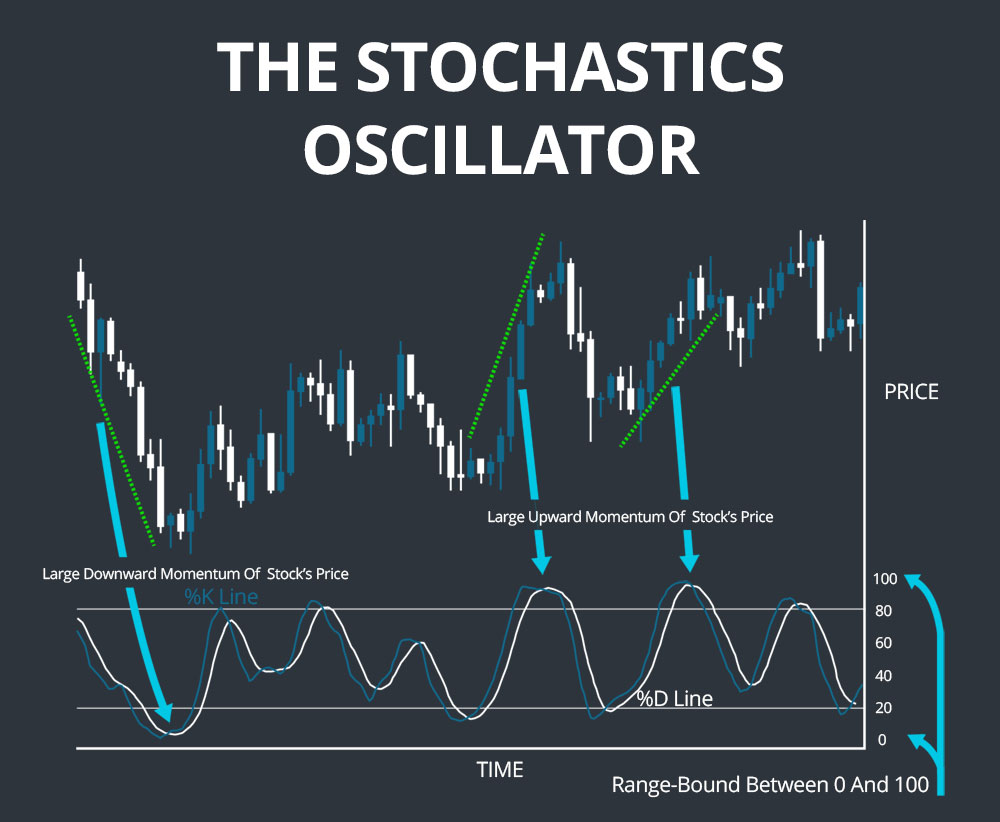

Basics of the Stochastic Oscillator

The original concept of the Stochastic Oscillator was introduced by George Lane in the 1950s. Lane believed momentum shifts before actual price reversals occur, making this tool valuable for forecasting changes. The calculation is straightforward but insightful. The indicator produces values between zero and one hundred, showing where the closing price stands relative to the highest and lowest prices of the chosen period, which is often fourteen. Higher values suggest the price is closing near the top of the range, while lower values indicate the price is closing near the bottom.

These readings provide a clear picture of how strong current momentum is. A reading above eighty signals that the market may be overbought, while a reading below twenty points to oversold conditions. Traders use these overbought and oversold signals to determine whether to prepare for reversals or trend continuation. What makes the Stochastic Oscillator especially attractive is its versatility. It works well on short-term intraday charts, such as five-minute or fifteen-minute timeframes, and it is equally effective on longer-term charts for swing traders or investors. By showing the relative strength of momentum, it allows traders to act with foresight rather than reacting late.

Reading Overbought and Oversold Signals in Detail

The most popular application of the Stochastic Oscillator involves analyzing overbought and oversold signals. These signals highlight exhaustion in price moves and provide traders with clues about when reversals are likely. Overbought conditions occur when the oscillator consistently reads above eighty, suggesting buyers may no longer sustain momentum. Oversold conditions occur when readings fall below twenty, hinting that sellers are losing control.

However, interpreting these signals requires context. In strong uptrends, the oscillator can remain in overbought territory for extended periods without a major correction. Similarly, in persistent downtrends, oversold conditions may continue while the price keeps falling. This is why professional traders rarely act on these readings in isolation. They combine them with trend direction, support and resistance levels, or candlestick patterns. For example, if EURUSD remains above eighty but begins to flatten near resistance while forming a bearish reversal candle, the signal strengthens. If GBPUSD trades below twenty but begins showing higher lows alongside bullish divergence, traders prepare for a bounce.

The ability to filter these signals separates beginners from professionals. While new traders may treat every overbought reading as a sell opportunity, experienced traders use them as early warnings, not automatic triggers. By understanding the dynamics of overbought and oversold conditions, the Stochastic Oscillator becomes a more accurate tool for decision-making.

How to Use Stochastic Oscillator in Forex Trading

Learning how to use the Stochastic Oscillator effectively requires understanding its two main components: the %K line and the %D line. The %K line reacts quickly to price movements, while the %D line smooths the signal by averaging %K values. When these lines cross, traders receive valuable insights into momentum changes. A %K crossover above %D in oversold territory often signals potential buying opportunities, while a %K crossover below %D in overbought zones may signal upcoming selling pressure.

Beyond crossovers, traders also use divergence to enhance their analysis. Bullish divergence occurs when price forms lower lows while the oscillator forms higher lows, suggesting selling momentum is weakening. Bearish divergence appears when price creates higher highs but the oscillator prints lower highs, showing buyers are losing strength. These divergence patterns help traders prepare for reversals before they are visible on price charts.

Another effective method involves using the oscillator to confirm trend continuation. For instance, during a strong uptrend, if the oscillator dips into oversold territory and then climbs back above the midline, it confirms that buyers are reentering the market. Likewise, in a downtrend, the oscillator rising briefly into overbought levels and then turning downward confirms that selling pressure remains intact. By applying these techniques, traders integrate the Stochastic Oscillator into practical trading decisions rather than treating it as a standalone indicator.

Stochastic Oscillator Trading Strategy for Forex

Developing a Stochastic Oscillator trading strategy requires more than simply reacting to indicator signals. A disciplined strategy involves combining the oscillator with trend analysis, price action, and risk management. One effective method begins with identifying the broader trend using a moving average. Traders then wait for the oscillator to enter extreme zones. When a crossover occurs in alignment with the dominant trend, they enter trades with greater confidence.

Consider an example with GBPUSD. Suppose the pair is trending upward above the fifty-period moving average. The Stochastic Oscillator falls below twenty, signaling oversold conditions. When %K crosses above %D, it indicates renewed buying momentum. A trader enters a long position, places a stop loss below the recent swing low, and sets a profit target near resistance. This approach avoids fighting the trend and reduces false entries.

The benefits of such a strategy are clear. It provides structure, eliminates guesswork, and helps traders avoid emotional mistakes. By using strict entry and exit rules, traders protect themselves from overtrading. Additionally, risk management ensures that a single losing trade does not erase gains. Over time, applying a Stochastic Oscillator trading strategy with discipline allows traders to build consistency, which is essential for long-term success in forex markets.

Stochastic Oscillator as a Momentum Indicator in Forex

The Stochastic Oscillator functions as a reliable momentum indicator in forex, giving traders a way to evaluate the speed and strength of price movements. Unlike simple trend-following indicators, it highlights whether momentum is accelerating or slowing, which often precedes market reversals. This predictive quality makes it a favorite among traders who value timing and precision.

Momentum plays a critical role in volatile markets. For example, during major news releases, price can move sharply in one direction. If the oscillator shows overbought conditions but begins to turn downward, it warns that momentum is fading even while price continues upward. Similarly, if the oscillator rises from oversold territory during a central bank announcement, it signals that selling pressure is weakening. Traders who pay attention to these shifts gain an edge by preparing for changes before the broader market reacts.

The oscillator’s role as a momentum indicator also makes it a valuable confirmation tool. If price breaks out of a consolidation range and the oscillator supports the move by climbing steadily, it suggests the breakout is genuine. If price breaks out but the oscillator lags or diverges, traders question the move’s sustainability. By relying on momentum insights, traders make smarter choices about which setups to trust and which to avoid.

Avoiding Common Mistakes With the Stochastic Oscillator

Despite its popularity, the Stochastic Oscillator is often misused by traders who fail to understand its limitations. One common mistake is assuming that every overbought signal is an invitation to sell and every oversold signal is an invitation to buy. In reality, these conditions can persist for long periods, especially in trending markets. Traders who ignore these situations often enter too early and face unnecessary losses.

Another mistake involves ignoring the broader trend. A trader may sell in overbought territory even though the market is in a strong uptrend. While the oscillator suggests exhaustion, price continues higher because underlying momentum remains strong. Failing to combine the oscillator with other analysis tools such as support, resistance, or moving averages leads to poor results. Overtrading is another issue. Because the oscillator moves frequently, inexperienced traders treat every crossover as a new signal. Without discipline, the result creates confusion and reduces profitability.

The solution lies in using the Stochastic Oscillator as part of a structured plan. Confirmation from other indicators, divergence analysis, and proper risk management all improve accuracy. Traders who backtest their approach and respect stop-loss placements avoid unnecessary drawdowns. By treating the oscillator as a supportive tool rather than a stand-alone system, traders unlock its real potential and avoid falling into common traps.

Final Thoughts

The Stochastic Oscillator continues to be a cornerstone of forex technical analysis. It provides valuable overbought and oversold signals, acts as a trusted momentum indicator in forex, and supports traders in developing structured trading strategies using the Stochastic Oscillator. More importantly, when traders know how to use Stochastic Oscillatorcorrectly, they reduce emotional mistakes and improve timing.

Its strength lies in its adaptability. From scalpers who rely on short timeframes to long-term swing traders who track weekly charts, the oscillator adapts without losing effectiveness. It remains relevant across major currency pairs, minor pairs, and even exotic ones. While no indicator is flawless, the Stochastic Oscillator consistently proves its worth when combined with sound analysis and disciplined risk management.

In conclusion, traders who commit to mastering the Stochastic Oscillator gain more than a tool. They gain a method of understanding momentum, reading market psychology, and positioning themselves ahead of reversals. With experience, it becomes not just an indicator, but a guide to making smarter, more confident trading decisions.

Frequently Asked Questions (FAQs)

Q1. What is the main purpose of the Stochastic Oscillator in forex trading?

The Stochastic Oscillator measures momentum by comparing a currency pair’s closing price to its recent high-low range. Its main purpose is to highlight overbought and oversold signals that warn traders about potential turning points. Since momentum often shifts before price does, this momentum indicator in forex allows traders to anticipate reversals early. By using it properly, traders can time entries and exits more effectively.

Q2. How reliable are overbought and oversold signals from the Stochastic Oscillator?

Overbought and oversold signals are helpful but not flawless. In strong uptrends, the Stochastic Oscillator may remain overbought for long periods, while in downtrends, it can stay oversold. Acting on these readings alone often leads to mistakes. Their reliability improves when combined with support and resistance levels, candlestick patterns, or divergence analysis. Treated as alerts rather than final triggers, these signals add value to a structured trading plan.

Q3. How to use Stochastic Oscillator effectively with other indicators?

Knowing how to use Stochastic Oscillator effectively involves blending it with other tools. Many traders pair it with moving averages to confirm trend direction. Candlestick patterns provide entry confirmation, while divergence helps identify weakening momentum. These layers turn it into the backbone of a reliable Stochastic Oscillator trading strategy, ensuring that signals are not only accurate but also actionable in live markets.

Q4. Can the Stochastic Oscillator be applied to all forex timeframes?

Yes, the Stochastic Oscillator works on all timeframes. Scalpers use it on short charts to catch intraday moves, while swing traders apply it on daily or weekly charts for bigger opportunities. It consistently produces overbought and oversold signals and remains a trusted momentum indicator in forex. Traders simply adjust expectations—shorter charts give more signals but with higher risk, while longer charts offer fewer but stronger signals.

Q5. What are the common mistakes traders make with the Stochastic Oscillator?

The most common mistakes include assuming every overbought signal means sell and every oversold signal means buy. Traders often ignore the broader trend, trade against momentum, or overtrade based on frequent crossovers. Others neglect risk management, increasing losses. To avoid these errors, traders should use the Stochastic Oscillator with confirmation from support, resistance, and candlestick analysis. Discipline and structured risk control turn this indicator into a dependable part of a trading system.

Read here to learn more about “What is CFD Trading and How Does It Actually Work in Markets?“

I’m Chaitali Sethi, a financial writer and market strategist focused on Forex trading, market behaviour, and trader psychology. I simplify complex market movements into clear, practical insights that help traders make better decisions and build a stronger trading mindset.