An Alternative Trading System (ATS) is an electronic marketplace where investors can buy and sell securities outside traditional stock exchanges. These systems connect buyers and sellers directly, using advanced algorithms to match orders quickly and efficiently. They provide faster execution, reduced transaction costs, and greater privacy—especially for large institutional trades that could otherwise influence market prices.

Institutional investors, hedge funds, and broker-dealers often use these private systems for trading large volumes discreetly. Although they operate outside public exchanges, every Alternative Trading System (ATS) is strictly governed by ATS Rules and Regulations and SEC Regulation ATS to maintain transparency and investor protection.

Unlike a public exchange that lists securities for open trading, an ATS focuses solely on executing transactions efficiently. The most common examples include Electronic Communication Networks (ECNs) and Dark Pool Trading Platforms, which together account for a significant share of global equity trading.

The increasing adoption of Alternative Trading Systems (ATS) reflects the financial sector’s broader move toward automation, speed, and algorithmic precision. These systems now form an essential part of the modern market ecosystem, providing liquidity, flexibility, and strategic advantages for institutional participants.

The Core Structure and Purpose of the Alternative Trading System (ATS)

The Alternative Trading System (ATS) exists to create a secure and efficient space for off-exchange securities trading. Typically run by registered broker-dealers, an ATS connects market participants through electronic order matching and ensures confidentiality throughout the process.

Every ATS must register with the U.S. Securities and Exchange Commission (SEC) and follow SEC Regulation ATS. This regulatory framework enforces fair access, recordkeeping, and operational transparency. These systems are required to report transaction data, safeguard investor information, and meet compliance standards designed to maintain market integrity.

For example, when a large investment fund wants to sell millions of shares, executing the trade through an ATS allows it to avoid alerting the broader market. The transaction happens privately, helping to prevent sudden price swings. In this way, Alternative Trading Systems (ATS) complement public exchanges, handling transactions where confidentiality and speed are essential.

Types of Alternative Trading Systems (ATS)

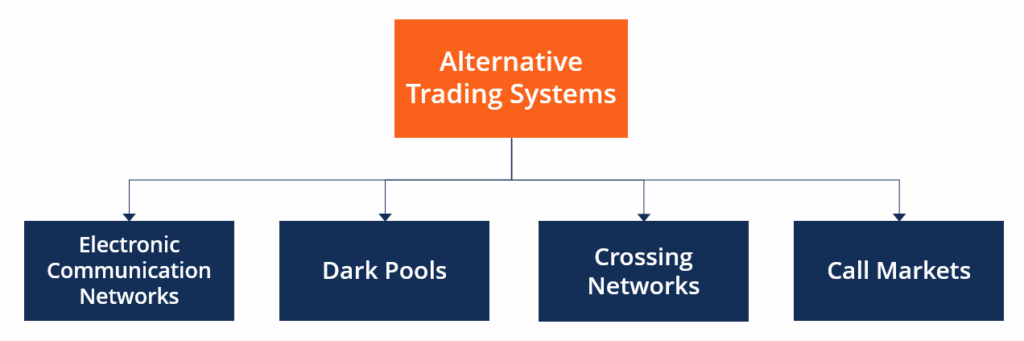

There are four primary types of Alternative Trading Systems (ATS), each serving distinct trading needs and offering specific advantages.

Electronic Communication Networks (ECNs)

Electronic Communication Networks (ECNs) are automated systems that display live buy and sell quotes, instantly matching orders by price and time priority. They bring transparency by showing active bids and offers and often operate 24 hours a day, enabling global participation. By reducing intermediary involvement, ECNs narrow spreads and enhance pricing fairness. Traders use ECNs to view real-time market depth, ensuring fast and competitive execution.

Dark Pool Trading Platforms

Dark pool trading platforms enable large institutions to trade anonymously. Orders remain invisible until after execution, protecting traders from price reactions caused by early market disclosure. These private venues are ideal for block trades and strategic positions that could move the market if made public. Although dark pools offer discretion, they still fall under SEC Regulation ATS, ensuring accountability and post-trade transparency.

Crossing Networks

Crossing Networks internally matches buy and sell orders, usually at benchmark prices such as the midpoint between bid and ask. Brokers or asset managers often use these platforms to aggregate liquidity from multiple sources and execute client orders together. They combine efficiency with reduced transaction costs and minimal price disruption.

Call Markets

Call markets gather buy and sell orders during a fixed interval, then execute them at a single clearing price. They reduce volatility and improve liquidity, particularly in thinly traded or auction-based markets.

Together, these types of Alternative Trading Systems (ATS) make up a diverse yet integrated ecosystem—balancing transparency, liquidity, and confidentiality across financial markets.

How the Alternative Trading System (ATS) Works

The Alternative Trading System (ATS) operates through a seamless combination of automation, regulation, and confidentiality. It serves as a digital bridge between buyers and sellers, ensuring that trades are executed quickly and privately without the need for a traditional stock exchange.

When an investor places an order, the system’s algorithms analyze available data to find a compatible counter-order based on price, volume, and timing. Once the match is identified, the transaction is executed electronically, ensuring precision and minimal delay. Unlike public exchanges where prices are visible, an ATS can process orders discreetly, shielding large trades from unnecessary market reactions.

Typical process flow:

- Order Submission: Investors or institutions submit buy or sell requests through the ATS platform.

- Order Matching: Advanced algorithms pair compatible orders while considering price priority and liquidity.

- Execution: Once a match is confirmed, the trade is completed automatically.

- Post-Trade Reporting: The executed trade is reported to regulators for compliance and market tracking.

- Settlement: The final step involves clearing and settlement through a recognized clearing house.

For example, a hedge fund may divide its large position between an Electronic Communication Network (ECN) for transparent pricing and a Dark Pool Trading Platform for discretion. This hybrid approach ensures better execution and reduced exposure to market volatility.

By automating each stage, the Alternative Trading System (ATS) minimizes human error, improves execution speed, and provides institutions with tools for sophisticated trading strategies. It has become an essential mechanism for bridging traditional exchanges with advanced, technology-driven trading environments.

ATS Rules, Regulations, and SEC Oversight

Every Alternative Trading System (ATS) operates under strict oversight governed by SEC Regulation ATS, designed to uphold transparency, fairness, and investor protection. The Securities and Exchange Commission (SEC) requires that all ATS platforms follow specific rules before operating in the financial markets.

To begin, every ATS must register as a broker-dealer and file Form ATS, detailing how the system functions, how orders are handled, and how clients gain access. Platforms that manage National Market System (NMS) securities must also submit Form ATS-N, providing additional transparency into their trading models and pricing mechanisms.

Key regulatory obligations include:

- Registration and Disclosure: All ATSs must register with the SEC before launch.

- Fair Access: If an ATS captures over 5% of the market in any security, it must provide equal access to all qualified participants.

- Record-Keeping: Detailed logs of orders, trades, and communication must be maintained for audits.

- Cybersecurity Measures: Systems must implement strict controls to protect sensitive trading data.

The SEC monitors compliance through audits, data reviews, and enforcement actions. In cases where operators mislead clients or fail to disclose material information—such as hidden order routing or data misuse—regulators can impose fines, sanctions, or trading suspensions.

This oversight ensures that Alternative Trading Systems (ATS) maintain integrity equivalent to traditional exchanges while offering the efficiency and innovation of electronic trading. Investors can thus trust that these systems operate transparently within a defined legal framework.

Transparency and Confidentiality in ATS Operations

Balancing transparency and confidentiality is vital to the effectiveness of every Alternative Trading System (ATS). Transparency encourages liquidity and fair pricing, while confidentiality protects investor strategies and minimizes market impact.

Electronic Communication Networks (ECNs) represent the transparent side of ATS operations. They display real-time order books, showing bid-ask spreads and trade volumes. This visibility helps market participants make informed decisions and improves overall market efficiency.

In contrast, Dark Pool Trading Platforms emphasize confidentiality. Orders remain undisclosed until after execution, allowing institutions to trade large blocks without revealing intentions. This anonymity prevents front-running and price distortion, two major risks in open exchanges.

To maintain fairness, regulators require that large ATS operators offering significant market share provide equal participation opportunities. SEC Regulation ATS ensures no investor receives preferential treatment or unfair advantage. Regular audits verify that systems maintain operational integrity and treat all orders consistently.

In practice:

- ECNs boost competition through open pricing data.

- Dark Pools preserve discretion for block trading.

- Fair access rules keep the playing field level.

This balance between visibility and privacy allows the Alternative Trading System (ATS) to operate efficiently for both institutional and professional traders, making it a vital component of the global financial ecosystem.

Advantages of Using the Alternative Trading System (ATS)

The Alternative Trading System (ATS) provides traders with speed, privacy, and cost efficiency — key features that make it essential for institutional trading. Unlike traditional exchanges, ATS platforms enable confidential execution, ensuring that large orders do not disrupt market prices.

Key Advantages:

- Privacy and Anonymity: Institutional investors can trade significant volumes without revealing their strategies. Platforms like Dark Pool Trading Systems maintain confidentiality until the trade is complete, preventing sudden price shifts.

- Speed and Automation: Advanced algorithms match buy and sell orders instantly, allowing participants to respond quickly to market changes.

- Lower Costs: By reducing intermediaries, ATS platforms help traders minimise broking and transaction fees. This cost-saving is especially beneficial for hedge funds and institutional investors executing large trades.

- Global Market Access: Traders can access multiple markets through a single digital interface, improving flexibility and liquidity.

- Strategic Flexibility: Systems like Electronic Communication Networks (ECNs) enhance transparency, while Crossing Networks and Call Markets cater to traders seeking specific execution styles.

In essence, the Alternative Trading System (ATS) bridges efficiency and confidentiality. As markets evolve, its role in providing low-cost, fast, and secure trade execution will only grow stronger.

Risks and Challenges in Alternative Trading Systems (ATS)

While the Alternative Trading System (ATS) enhances trading efficiency, it also brings potential risks that require tight regulation. Market fragmentation, conflicts of interest, and cybersecurity threats pose major challenges to its long-term stability.

Main Risks:

- Market Fragmentation: With many ATS platforms, liquidity spreads thinly, affecting price discovery and market transparency.

- Information Asymmetry: Some participants may exploit data advantages, creating an uneven playing field.

- Conflicts of Interest: Broker-dealer-run ATSs must ensure fair order routing to avoid favouritism.

- Cybersecurity Threats: As digital systems expand, risks of hacking and data breaches increase.

- Regulatory Violations: Operators face heavy penalties for misleading clients or mishandling orders, as seen in past dark pool cases.

To mitigate risks, regulators enforce SEC Regulation ATS, conduct audits, and require transparent reporting. Operators also invest in encryption and surveillance systems to uphold trust and fairness.

The Future of the Alternative Trading System (ATS)

The Alternative Trading System (ATS) is rapidly evolving with technology and global market integration. Emerging innovations are transforming how trades are executed and settled.

Key Developments Shaping the Future:

- AI and Predictive Analytics: Artificial intelligence helps identify liquidity zones and optimise trade timing for better execution.

- Blockchain Integration: Blockchain-based systems promise near-instant settlements and transparent transaction records.

- Hybrid Models: Combining ECN transparency with Dark Pool privacy gives traders both visibility and discretion.

- Global Connectivity: New ATS networks link multiple regions, enhancing international liquidity access.

Some platforms already test blockchain settlements that cut clearing times from two days to minutes — a major leap toward real-time finance.

In the years ahead, the Alternative Trading System (ATS) will continue to evolve into a faster, safer, and more intelligent ecosystem — driving innovation and efficiency across global capital markets.

Conclusion

The Alternative Trading System (ATS) has revolutionised how securities are traded, offering speed, efficiency, and discretion beyond traditional exchanges. Regulated under SEC Regulation ATS and ATS Rules and Regulations, these systems ensure fairness while giving investors more control over their trades.

Through models like Electronic Communication Networks (ECNs), Dark Pool Trading Platforms, Crossing Networks, and Call Markets, ATSs have become integral to institutional trading. As technology continues to advance, they will remain at the centre of financial innovation—bridging the gap between regulation, automation, and market transparency.

Frequently Asked Questions

1. What is an Alternative Trading System (ATS)?

An Alternative Trading System (ATS) is a private electronic platform that allows investors to trade securities outside traditional exchanges. It connects buyers and sellers directly through automated systems, offering faster execution, reduced costs, and greater privacy for large transactions.

2. How does an Alternative Trading System (ATS) differ from a stock exchange?

Unlike public exchanges that list securities, an ATS focuses solely on trade execution. It does not determine listing requirements or issue securities. Institutional investors and broker-dealers often use it as an electronic venue for efficient trade matching.

3. What are the main types of Alternative Trading Systems (ATS)?

The four key types include:

- Electronic Communication Networks (ECNs): Provide real-time order transparency.

- Dark Pool Trading Platforms: Allow confidential, large-volume trades.

- Crossing Networks: Match orders internally to reduce costs.

- Call Markets: Execute trades at scheduled times to improve liquidity.

4. How does SEC Regulation ATS protect investors?

SEC Regulation ATS ensures all systems operate with fairness and accountability. It requires platforms to register as broker-dealers, maintain trade records, disclose order handling procedures, and follow cybersecurity standards. Non-compliance can lead to fines or suspension.

5. Why do institutional investors prefer ATS platforms?

Institutional investors rely on Alternative Trading Systems (ATS) for their privacy, speed, and reduced market impact. By avoiding public visibility, large trades can execute smoothly without causing major price swings, ensuring more stable and predictable outcomes.

Read here to learn more about “Bollinger Bands in Forex Trading: Clear Guide to Smarter Decisions“

I’m Chaitali Sethi, a financial writer and market strategist focused on Forex trading, market behaviour, and trader psychology. I simplify complex market movements into clear, practical insights that help traders make better decisions and build a stronger trading mindset.