Every forex trader and global business depends on exchange rates to measure value. The distinction between spot rate vs forward rate sits at the centre of these financial interactions. These two rates determine how currencies are exchanged today and how they are priced for the future.

The spot rate represents the current market price for a currency pair — the rate used for immediate exchange. It reflects live market conditions shaped by supply, demand, and investor sentiment. The forward rate, on the other hand, is a pre-agreed price set today for a transaction that will occur later. It helps traders, corporations, and investors manage the risks of uncertain markets.

The difference between spot and forward rates is not just a technical detail; it shapes global trade, investment flows, and risk management strategies. Understanding both also reveals how foreign exchange rate determination works in real life — connecting macroeconomics, central bank policy, and global money movement.

For beginners, learning spot and forward exchange rates explained through real-world examples offers clarity and builds confidence in navigating one of the world’s most dynamic financial markets.

What Is a Spot Rate and How Does It Work?

The spot rate is the price of one currency in terms of another at a specific moment. It tells traders how much of one currency they can get immediately for another. Transactions based on the spot rate usually settle within two business days, which is why it’s called the “cash market”.

Spot rates change constantly. They respond to every piece of global information — an interest-rate announcement, a change in inflation data, or a geopolitical event. For instance, if the EUR/USD spot rate is 1.1050, it means one euro can be exchanged for 1.1050 U.S. dollars right now. A sudden U.S. rate hike might strengthen the dollar, causing that number to drop within minutes.

Several elements influence spot rates. Interest rates are among the strongest drivers because higher yields attract capital and push a currency higher. Inflation also plays a role; currencies from countries with low inflation tend to hold stronger purchasing power. Economic growth, employment data, and trade balances further shape daily fluctuations.

Political stability also matters. Investors prefer safe, predictable environments, so currencies from countries with strong governance often appreciate faster than those from unstable regions. In this sense, spot rates act like economic health indicators. They show how investors perceive a country’s strength at any given time.

For short-term traders, the spot rate is the starting point for every decision. For analysts and economists, it is the benchmark used in broader foreign exchange rate determination models.

Understanding Forward Rate and Its Importance

A forward rate is an exchange rate agreed upon today for a transaction that will happen later. It serves as a bridge between current value and future expectations. While spot rates focus on “now”, forward rates represent the future price of money across borders.

For example, if the current USD/INR spot rate is ₹83 and the three-month forward rate is ₹84.20, it means an Indian importer can lock in that ₹84.20 rate today for payment due three months later. Whether the rupee strengthens or weakens in the future, the cost remains fixed.

Forward rates are essential because they allow businesses and investors to plan ahead with certainty. They reduce risk from unexpected currency swings, especially in volatile markets. If global inflation rises or central banks change policy, forward contracts protect profits by fixing exchange rates early.

The difference between spot and forward prices mainly comes from interest rate differentials. A currency with higher domestic interest rates often trades at a forward discount, suggesting it might weaken later. A currency with lower interest rates may trade at a forward premium. This relationship ties directly to how foreign exchange rate determinationensures market balance.

Forward contracts are crucial for currency hedging in forex, helping corporations, exporters, and importers stabilise their financial outlook. They are also useful for traders seeking to speculate on where currencies might move based on macroeconomic expectations.

Difference Between Spot and Forward Rate

Although both terms describe exchange rates, their function and timing differ. The spot rate applies to immediate exchanges and reflects current conditions. The forward rate applies to future transactions, reflecting expectations about economic and interest-rate trends.

In the short term, the spot rate reacts to daily market changes — political news, central bank meetings, or sudden capital flows. The forward rate, by contrast, smooths these fluctuations and provides a long-term perspective.

To make the distinction clearer, imagine a British company expecting U.S. dollar payments six months from now. If the pound strengthens by that time, the firm will receive fewer pounds when converting dollars. To avoid such risk, it uses a forward contract to lock in today’s rate. That single decision ensures predictable revenue even if the market changes dramatically.

In essence, spot rates represent the market’s heartbeat, while forward rates act as its forecast. Traders often monitor both together to balance immediate opportunities with future protection. Businesses depend on this difference to plan international operations effectively and maintain financial stability.

How Forward Rates Are Calculated

Forward rates aren’t random estimates; they follow a precise mathematical relationship involving spot prices and interest rates. This link maintains market equilibrium and prevents risk-free arbitrage opportunities.

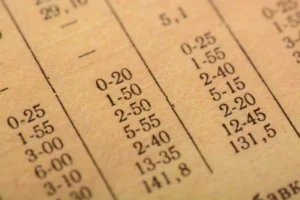

The basic formula is:

Forward Rate = Spot Rate × (1 + Domestic Interest Rate) / (1 + Foreign Interest Rate)

Suppose the EUR/USD spot rate is 1.1000. If the Eurozone interest rate is 3% and the U.S. interest rate is 5%, the one-year forward rate will be:

1.1000 × (1.03 / 1.05) = 1.0786

This calculation suggests the euro might weaken relative to the dollar if all other factors remain equal.

This formula also demonstrates a concept called interest rate parity, meaning currencies adjust to offset differences in interest rates between countries. It’s a foundation of foreign exchange rate determination and ensures fairness across global markets.

For traders, understanding this relationship helps forecast currency trends more accurately. For businesses, it’s a tool for setting realistic expectations when creating forward contracts or evaluating the cost of overseas transactions.

Real-World Examples

Seeing spot and forward exchange rates explained through actual situations makes the concept clearer.

A traveller exchanging euros for dollars at an airport is using the spot rate. The transaction is immediate, and the traveller receives dollars right away based on that day’s value.

Now consider a U.K. furniture exporter selling goods to Canada. The company will be paid in Canadian dollars three months later. If the pound rises before that time, the exporter’s income in pounds could drop. To prevent losses, the company signs a forward contract today to exchange future payments at a fixed rate.

Similarly, a forex trader might notice that the one-year forward rate for GBP/USD is lower than the current spot rate. That gap signals expectations that the pound might weaken. The trader could use that information to position trades in line with market sentiment.

These cases highlight why understanding both rates is essential. The difference between spot and forward rates is not just about timing but about strategy, risk control, and financial discipline.

Currency Hedging in Forex: Reducing Risk and Stabilising Profits

Every business dealing in multiple currencies faces exchange-rate risk. Currency hedging in forex is the process of protecting against that risk, and forward contracts are one of the most common tools for doing so.

When a company uses forward contracts, it essentially fixes its future exchange rate today. This ensures that even if market conditions change drastically, the company’s expenses or revenues remain stable. For instance, an airline buying fuel priced in U.S. dollars can hedge months ahead to avoid unexpected cost increases caused by currency fluctuations.

Other hedging instruments include options, futures, and swaps. Currency options allow flexibility — the holder can choose whether or not to exercise the contract. Futures are standardised and exchange-traded, while swaps involve exchanging cash flows between currencies over a longer period.

Hedging not only protects corporate profits but also adds predictability to cash flow management. For traders, it acts as a safety net during volatile periods. In broader terms, effective hedging practices stabilise global markets by reducing panic and limiting sudden capital movements.

Influence of Central Banks on Spot and Forward Rates

Central banks shape both spot rate vs forward rate through their monetary policies. When a central bank raises interest rates, investors earn more from assets in that currency, driving up demand and strengthening the spot rate. Over time, the forward rate also adjusts to reflect these expectations.

For example, during 2023–2024, the U.S. Federal Reserve increased rates several times to control inflation. The dollar gained strength across major pairs like EUR/USD and GBP/USD, pushing spot prices higher. Forward rates also rose because markets anticipated continued tightening.

Meanwhile, the Bank of Japan maintained near-zero rates, causing the yen to trade at a forward discount. These contrasting policies show how foreign exchange rate determination reacts to monetary actions.

For traders and businesses alike, following central bank announcements is critical. It provides a view into future rate trends, helping them adjust strategies and hedging decisions accordingly.

How Spot and Forward Rates React During Market Volatility

Market crises and geopolitical shocks often create large swings in exchange rates. The spot rate responds instantly, reflecting short-term emotion and uncertainty. The forward rate, however, tends to move more cautiously, reflecting long-term expectations.

During the early months of the 2020 pandemic, for instance, many emerging-market currencies like the Brazilian real and Indian rupee depreciated rapidly in the spot market as investors rushed toward safe assets. Yet their forward rates showed only moderate declines, suggesting traders expected recovery over the following year.

This difference between immediate panic and long-term adjustment shows how spot and forward rates together reveal market psychology. Spot rates expose short-term fear or excitement; forward rates measure calm analysis and future confidence.

For long-term traders and corporations, this balance provides valuable insight into when to hedge, when to wait, and when to adjust exposure.

How Businesses Use Forward Rates for Stability

Multinational businesses rely on forward rates to plan and protect their finances. Even small shifts in exchange rates can affect profit margins dramatically. The difference between spot and forward rates helps determine whether to execute a transaction now or secure a fixed price for later.

For instance, a German car manufacturer exporting to the U.S. receives payments in dollars but pays workers in euros. If the euro strengthens, profits could fall when converted. By locking in a forward rate, the company secures predictable revenue.

Energy companies and airlines also hedge currency exposure to manage costs of imported fuel or equipment. Investment funds use forwards to manage global portfolios spread across multiple currencies.

Forward rates are thus not speculative bets — they’re essential planning tools for anyone with foreign cash flow exposure. They bring stability in an otherwise unpredictable market, allowing organisations to focus on productivity and growth instead of short-term volatility.

How Traders Combine Spot and Forward Rates Strategically

Professional forex traders rely on both the spot rate and the forward rate to understand the true structure of the market. The spot rate reflects immediate price action — the pulse of trader sentiment and short-term momentum — while the forward rate represents what investors expect will happen in the future. Analysing both together helps identify opportunities that pure technical or fundamental analysis might miss.

When the forward rate is higher than the spot rate, it signals that the market expects the base currency to strengthen over time. When it’s lower, it suggests likely depreciation ahead. This spread, known as the forward differential, becomes a crucial indicator of where institutional investors anticipate currency direction.

Many professionals use this relationship to execute carry trades — borrowing in low-interest currencies and investing in higher-yield ones to profit from the interest differential. The forward rate guides whether the yield advantage justifies the potential risk.

Traders who integrate both rates gain a complete view of market dynamics. Instead of reacting emotionally to daily volatility, they forecast outcomes using both real-time data and forward expectations.

In practice, traders use this strategy to:

- Forecast long-term trends using forward-rate signals while managing short-term volatility through spot price movements.

- Adjust risk exposure when forward pricing diverges sharply from spot levels.

- Optimise hedging positions to protect against unexpected macroeconomic shifts.

Understanding spot and forward exchange rates explained together allows traders to align decisions with institutional sentiment and manage timing with greater precision — turning data into strategic foresight.

Technology’s Expanding Role in Exchange-Rate Management

Technology has completely transformed how traders and corporations manage currency exposure. Modern AI-driven systems analyse spot rate vs forward rate fluctuations in real time, processing vast data streams from across the globe. This automation enables faster decision-making, sharper accuracy, and stronger control over financial outcomes.

Machine learning algorithms constantly scan global indicators such as inflation, interest rates, and political events to identify subtle correlations. They help predict potential forward-rate shifts before human analysts detect them. Treasury departments now use cloud-based systems to simulate thousands of scenarios and evaluate which foreign exchange rate determination factors have the highest impact on future pricing.

Key technological breakthroughs include:

- AI and Predictive Analytics: Generate near-instant insights into rate movements and volatility patterns.

- Cloud-Based Hedging Platforms: Allow treasury teams to manage multiple forward contracts efficiently across regions.

- Blockchain and Smart Contracts: Enable secure, transparent, and automated settlement of forward transactions, minimising counterparty risk.

These innovations have made foreign exchange rate determination faster, more transparent, and data-driven. Even small and mid-sized enterprises can now use the same tools that global banks rely on — improving efficiency, reducing costs, and enhancing decision-making accuracy.

By combining digital platforms with analytical foresight, both traders and corporations can model future exchange outcomes with confidence. Technology no longer just supports forex trading—it drives it, ensuring every move between spot rate vs forward rate is calculated, traceable, and strategically optimised for global success.

Key Takeaways

- Spot rate represents the current market price for immediate transactions, influenced by demand, supply, and sentiment.

- Forward Rate is the pre-agreed future rate that helps hedge against volatility and predict long-term movement.

- The difference between spot and forward rates lies in timing, calculation, and purpose — short-term execution versus long-term protection.

- Currency hedging in Forex allows traders and corporations to stabilise earnings and manage risk in uncertain markets.

- Foreign Exchange Rate Determination connects all these factors, combining policy, interest rates, and global economics to define fair value.

Final Thoughts

The relationship between spot rate and forward rate shapes every decision in the forex world. The spot rate reveals current market reality; the forward rate projects tomorrow’s expectations. Together, they provide the most accurate picture of how currencies behave in a global economy driven by change.

For beginners, understanding both rates means understanding the language of global finance. It’s not just about trading — it’s about recognising how interest rates, inflation, and policies translate into real value.

When traders and businesses grasp how spot and forward exchange rates are explained through market mechanics, they gain the power to plan strategically rather than react emotionally. Combined with smart currency hedging in forexand awareness of foreign exchange rate determination, this knowledge turns volatility into opportunity.

Whether you’re managing a global business or exploring forex trading for the first time, these two rates—spot and forward—will always define how the financial world moves, grows, and connects.

Frequently Asked Questions (FAQ)

1. What is the difference between spot rate and forward rate?

The difference between spot and forward rates lies mainly in timing. The spot rate shows the current price for immediate exchange, while the forward rate is a future price agreed upon today. Traders use spot rates for instant transactions and forward rates to hedge or plan ahead.

2. Why are forward rates important for businesses?

Forward rates allow companies to manage financial risk. By locking in a price through currency hedging in forex, businesses protect future cash flows from volatility, ensuring stable profits even when exchange rates move sharply.

3. Do forward rates predict future spot rates?

Not exactly. A forward rate reflects current expectations based on interest-rate gaps, but it doesn’t guarantee where the spot rate will actually be later. Market surprises can shift future outcomes.

4. How do central banks affect these rates?

Central banks influence both rates through interest-rate decisions and monetary policy. A rate hike strengthens the spot rate and often pushes up forward values, shaping overall foreign exchange rate determination.

5. Can individual traders use forward contracts?

Yes. Many brokers offer simplified forward or futures contracts to help retail traders manage exposure. Understanding spot rate vs forward rate helps them balance short-term trades with longer-term planning.

6. Why should beginners learn both rates?

Knowing both gives traders a complete view of market behaviour. Spot rates reveal real-time value, while forward rates indicate how the market expects currencies to perform in the future. Together, they form the basis for smart, confident trading decisions.

Read here to learn more about “5 Proven Rules for Profitable and Risk-Free Options Trading“

I’m Chaitali Sethi, a financial writer and market strategist focused on Forex trading, market behaviour, and trader psychology. I simplify complex market movements into clear, practical insights that help traders make better decisions and build a stronger trading mindset.