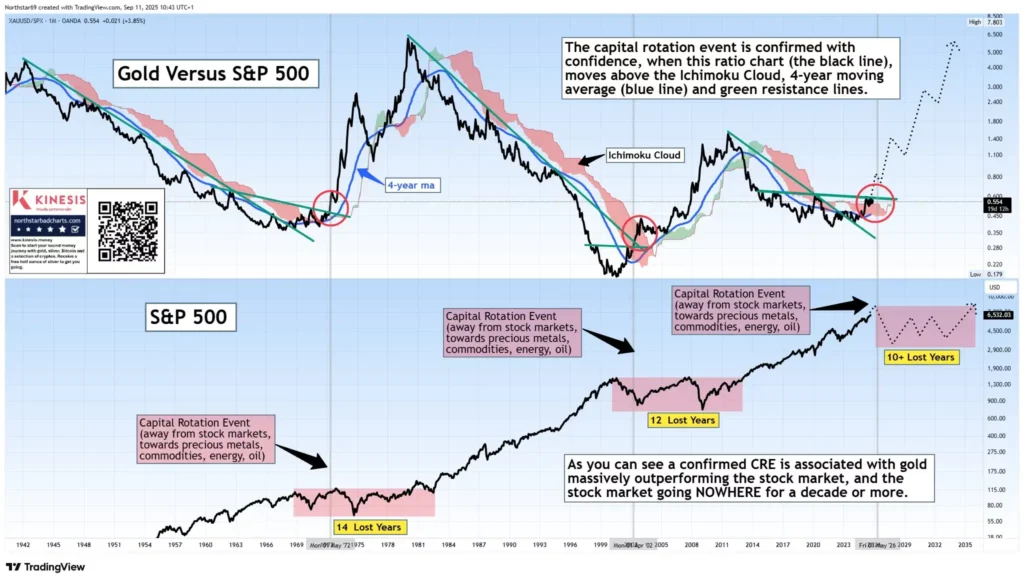

The Gold vs S&P 500 Rotation 2025 is not just another market story. It is a defining signal for investors, one that could determine who preserves wealth and who watches years of gains evaporate. The ratio between gold and equities has started a powerful move, a shift known as a capital rotation event. This shift, once triggered, rarely lasts a few months. Instead, history shows it often dominates markets for a decade or more.

In previous cycles, stocks entered what economists now call a stock market lost decade. During those times, equities struggled to deliver real returns, while gold entered a gold boom cycle, multiplying in value several times over. The setup today resembles both the 1970s and the early 2000s, where inflation, debt, and valuation extremes lined up against equities.

This is why traders, long-term investors, and even pension funds are paying close attention. The Gold vs S&P 500 Rotation 2025 not only points toward a possible stock market crash in 2025 but also raises the urgency of a gold price prediction for 2025 that could see the metal double or even triple in the years ahead.

Why the Ratio Matters More Than Ever

The ratio between gold and the S&P 500 is not a new concept, but it is one of the most powerful long-term signals for investors. It acts as a mirror, showing where capital prefers to flow. When the ratio rises, it tells us that gold is outperforming equities, often during times of stress, inflation, or structural weakness in stock markets. When the ratio falls, equities dominate, reflecting growth, stability, and investor optimism.

Unlike daily price swings, which can be noisy and misleading, this ratio captures multi-year shifts in market leadership. It highlights when investors should prepare for a capital rotation event. Right now, the ratio is once again climbing, confirming that money is moving out of equities and into precious metals. This is not random. It is the same pattern seen before every major gold boom cycle.

The 1970s offer a powerful example. The gold-to-equity ratio skyrocketed as gold outperformed stocks for 14 straight years. Those who trusted gold saw life-changing returns, while stock investors endured what became known as a lost decade. The early 2000s told the same story. As the dot-com bubble burst and later the financial crisis struck, gold surged while equities stagnated. Contrarian investors who recognised the ratio’s signal built generational wealth.

The Gold vs S&P 500 Rotation 2025 is repeating these lessons. With inflation pressures, unsustainable debt levels, and ongoing currency debasement, the stage is set for another gold boom cycle. Ignoring the ratio means risking a decade of stagnation. Respecting it means positioning for opportunity when others remain trapped in underperforming assets.

Stock Market Crash 2025: Rising Probability

The possibility of a stock market crash in 2025 has become one of the most debated topics in financial circles. While no one can predict the exact day when markets will break, the conditions that set the stage for a crash are easier to recognise. At present, almost all those warning signs are flashing together.

Equities remain dangerously stretched. The S&P 500 trades at valuations that historically precede weak or even negative returns. Price-to-earnings multiples are near extremes last seen before the dot-com collapse and the global financial crisis. Earnings growth no longer justifies these levels, and yet liquidity-driven speculation continues to push prices higher.

Bonds, which once offered reliable protection, are no safer. Yields remain high, putting stress on corporate borrowers, governments, and households alike. Debt service costs are climbing to unsustainable levels. Property markets across advanced economies show similar cracks. Prices remain expensive even as affordability weakens under the pressure of higher mortgage rates.

With all three pillars—stocks, bonds, and property—at or near historical peaks, gravity eventually pulls down. Crashes do not always come as sudden collapses like 2008. Sometimes the pain is slower, hidden in years of stagnation. A market that delivers flat or declining returns while inflation rises still produces a stock market lost decade.

The Gold vs S&P 500 Rotation 2025 warns that this process is already in motion. The ratio is shifting, signalling that capital is leaving equities for gold. For investors, the danger is not only a dramatic crash but also the grinding erosion of wealth over years. Positioning into gold early may be the only way to escape this trap and benefit from the next gold boom cycle.

Gold Price Prediction 2025: The Upside Ahead

Making a gold price prediction for 2025 is not about wild guesses or hopeful speculation. It is about carefully recognising patterns that repeat across decades of financial history. Every time the ratio between gold and stocks has turned in gold’s favour, a new long-term cycle has emerged. In the 1970s, this signal took gold from just $35 an ounce to over $800, transforming it into the decade’s best-performing asset. In the 2000s, the same ratio shift began after the dot-com bust. Gold climbed from $250 to nearly $1900 while equities struggled through crises and inflation shocks.

The Gold vs S&P 500 Rotation 2025 is echoing these earlier transitions. Technically, gold has broken above the Ichimoku Cloud and its four-year moving averages, which are classic breakout signals. Fundamentally, conditions also point higher. Inflation remains sticky despite central bank tightening. Currency debasement continues as governments expand debt-financed spending. At the same time, geopolitical uncertainty—from trade conflicts to regional instability—pushes investors toward safe-haven assets. These combined forces are laying the groundwork for another gold boom cycle.

A realistic gold price prediction for 2025 places the metal well above $3000 within the next few years. Over a longer horizon, levels of $4000 or even $5000 per ounce are within reach if capital rotation continues at the current pace. These targets may sound bold, but they are consistent with the scale of past moves during capital rotation events.

The lesson for investors is clear: this is not a quick trade but a structural cycle. The gold boom cycle rewards those with conviction, patience, and a long-term inflation hedge strategy. Those who act early are best positioned to capture the upside before the trend becomes obvious to everyone else.

The Power of a Capital Rotation Event

A capital rotation event is one of the most powerful forces in financial markets, and it does not occur often. Unlike normal market corrections, which may last weeks or months, a capital rotation event represents a long-term structural shift in where money flows. When it begins, it changes the investment landscape for years. Capital leaves overvalued assets and seeks safety in undervalued or alternative stores of value. The Gold vs S&P 500 Rotation 2025 is proof that such a transformation is already underway.

The scale of these moves cannot be underestimated. Institutional investors—pension funds, sovereign wealth funds, insurance companies, and hedge funds—control trillions of dollars. When they reallocate even a small percentage of their portfolios, the effect on gold, silver, and mining equities is enormous. This creates a reinforcing loop: as gold rises, more investors move in to protect or grow returns, which pushes the price even higher. The momentum builds until gold becomes the dominant performer.

History confirms the pattern. In the 1970s, a capital rotation event helped gold rise nearly tenfold, rewarding those who recognised the shift early. The 2000s provided another example, as gold surged from $250 to almost $1900 while stocks endured a lost decade. Both times, the winners were those who paid attention to the signals and moved before the majority.

In 2025, the same story is repeating. Inflation pressures, debt overload, and currency debasement are aligning with technical breakouts in the gold-to-equities ratio. Recognising this capital rotation event early is critical. It will likely separate those who thrive during the coming stock market lost decade from those who merely endure it. The difference lies not in timing perfection but in understanding the structural change that is already unfolding.

Stock Market Lost Decade: A Hidden Threat

Most investors fear sudden crashes, but the stock market’s lost decade is often worse. It is less dramatic but more destructive. It traps investors in underperforming assets for years, draining confidence and wealth through slow erosion.

The 1970s delivered one such decade. Inflation ran high, real returns from stocks were negative, and gold surged. The early 2000s repeated the experience, with equities delivering nothing after inflation while gold boomed.

The Gold vs S&P 500 Rotation 2025 signals another lost decade may already be starting. Equities sit at valuations similar to past peaks. Debt levels are unprecedented. Inflation remains persistent. Together, these factors make the case that stocks may struggle for years while gold enjoys another gold boom cycle.

For investors, this means building an inflation hedge strategy now. Waiting until the market confirms the lost decade is too late.

Technical Confirmation: Ichimoku Cloud and Moving Averages

Technical analysis adds weight to the story. Gold has broken above the Ichimoku Cloud, a signal that usually marks the start of a powerful trend. At the same time, it trades above its four-year moving averages. This alignment rarely occurs by chance.

Before the massive rallies of the 1970s and the 2000s, gold showed the same breakout. Once the signals flashed, gold entered multi-year uptrends that multiplied its price several times over.

The Gold vs S&P 500 Rotation 2025 shows the same alignment. The ratio itself confirms that gold is outperforming equities, while technical signals show that gold is beginning another gold boom cycle. Together, these signals make a strong case for building conviction now.

A Heavy Gold Strategy for Compounding Wealth

Building wealth during a gold boom cycle requires strategy. A heavy gold strategy begins with a core position. This can be physical gold for long-term stability, funds for liquidity, or miners for leverage. The key is to start early.

Corrections will happen, but they should be used as opportunities. Adding on dips at key support levels compounds returns over the long cycle. In the 2000s, those who bought every pullback in gold saw extraordinary gains by the end of the decade.

Silver plays a role too. While more volatile, it often outperforms gold in the later stages of the cycle. Investors with higher risk tolerance can use silver to enhance returns. Combined, gold and silver form the core of an inflation hedge strategy that protects wealth during a stock market lost decade.

Urgent 2025 Advice: Don’t Wait

The most urgent advice for 2025 can be summed up in one sentence: act before the crowd. By the time mainstream media headlines confirm that a gold boom cycle is underway, much of the best upside will already be captured. History proves that the biggest gains in gold happen during the early stages of a capital rotation event, when most investors are still sceptical. Those who hesitate risk chasing higher prices later, often after the smartest money has already positioned itself.

Practical positioning does not require complex strategies. It requires conviction and preparation.

- Physical gold provides the ultimate anchor for long-term wealth, immune to counterparty risk and market manipulation.

- ETFs allow flexible exposure and easy liquidity for traders and investors alike.

- Mining stocks deliver leveraged upside, often rising faster than the metal itself during a gold boom cycle.

- Royalty and streaming companies offer diversified growth with less operational risk compared to traditional miners.

- Silver remains the high-beta play, historically outperforming gold once momentum accelerates.

The Gold vs S&P 500 Rotation 2025 is not about catching a perfect entry or trading short-term volatility. It is about recognising that a structural capital rotation event is unfolding—a shift that could define global markets for the next decade. Each pullback in gold or silver prices should be viewed not with fear but as an opportunity to build conviction positions.

The earlier investors align themselves with this rotation, the greater their chances of compounding wealth over the entire cycle. Waiting for confirmation may feel safer, but history shows it is the riskiest move of all.

Final Warning: The Rotation Has Begun

The Gold vs S&P 500 Rotation 2025 is flashing the same unmistakable signals that marked past generational turning points. The ratio is climbing, gold has broken out technically, and fundamentals are aligning for a major shift. A stock market crash in 2025 could accelerate this move dramatically, but even without a sudden collapse, the real story is the risk of a stock market lost decade that follows. While equities face stagnation, gold is entering a gold boom cycle, supported by both technical strength and powerful macroeconomic forces.

This is the moment to build an inflation hedge strategy with conviction. Once a capital rotation event begins, it rarely ends quickly. History shows these rotations can last ten years or longer, reshaping where wealth is created and destroyed. Those who ignore the signals risk watching a full decade pass with little or no equity growth, while inflation quietly erodes purchasing power.

In contrast, those who recognise the gold boom cycle early and position accordingly can secure generational wealth. The tools are available—physical gold, ETFs, miners, royalty firms, and silver—and the signals are flashing now. The danger lies not in acting too soon but in waiting until the crowd rushes in, by which time much of the easy upside will be gone.

The rotation has already started. Capital is leaving overvalued markets and moving into safe havens. The only question that matters is whether you will prepare for it or be left behind. History will reward those who act now with conviction and patience, while punishing those who dismiss the warnings. The Gold vs S&P 500 Rotation 2025 is more than a chart; it is the roadmap for the next decade.

Read here to learn more about “How Volume Scalping Works in Real Time for Consistent Trades“

I’m Chaitali Sethi, a financial writer and market strategist focused on Forex trading, market behaviour, and trader psychology. I simplify complex market movements into clear, practical insights that help traders make better decisions and build a stronger trading mindset.