The symmetrical triangle pattern stands out as one of the most recognised and reliable formations in technical analysis. Whether you trade forex, stocks, crypto, or commodities, you have probably seen this price consolidation pattern appear just before the market makes a decisive move. When the market narrows into a triangle, it reflects a standoff between buyers and sellers, causing price swings to shrink and tension to mount with each passing session.

This chart pattern attracts the attention of both novice and experienced traders because it delivers clear, actionable signals without unnecessary complexity. As the price range tightens, anticipation builds among market participants. The symmetrical triangle pattern often signals that a major breakout trading opportunity is on the horizon, and those who recognise it early are often well positioned to profit.

Learning to identify the symmetrical triangle pattern is about more than just memorising shapes on a chart. It is about understanding how markets consolidate, why breakouts occur, and how to turn those moments of indecision into high-probability trades. With the right symmetrical triangle trading strategy, you can consistently spot these price consolidation patterns and catch some of the market’s most significant moves. This guide will help you recognise the pattern, understand why it works, and apply proven strategies so you can trade with greater confidence and skill in any market you choose.

What Is a Symmetrical Triangle Pattern?

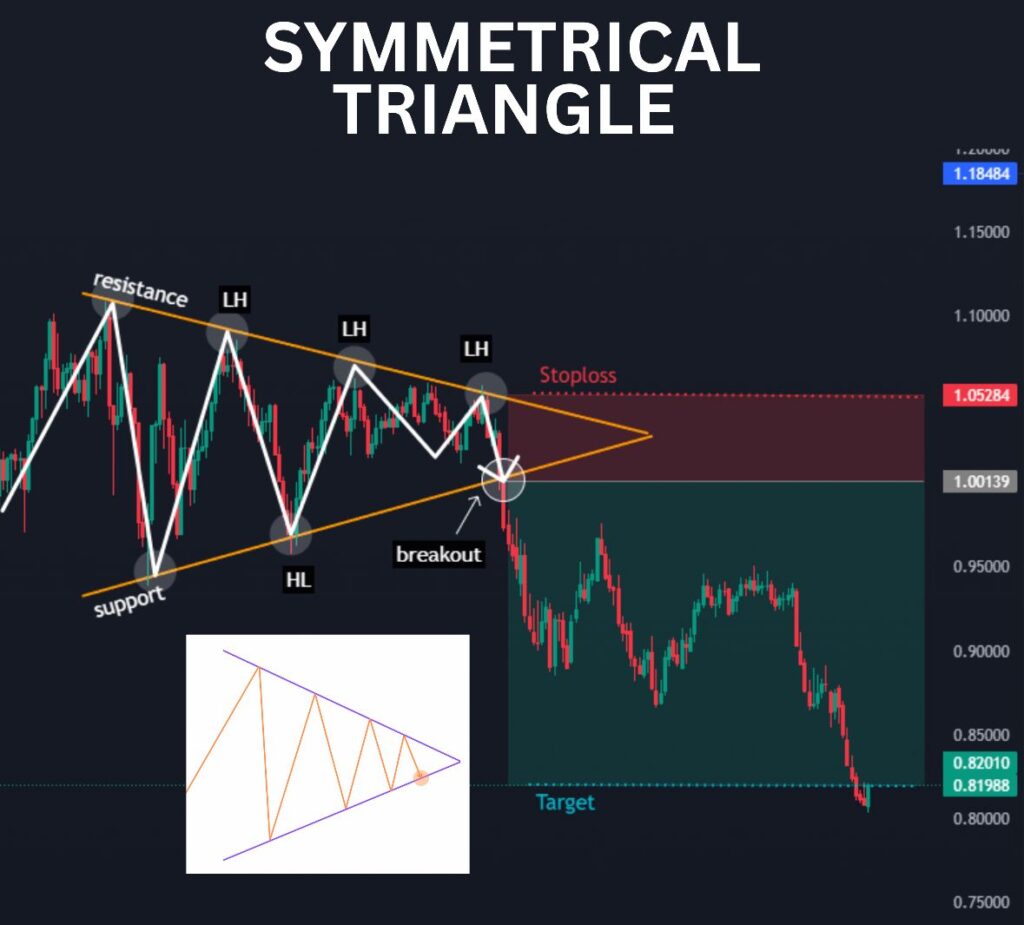

A symmetrical triangle pattern is a technical formation on price charts, created by drawing two converging trendlines: one connecting lower highs and one connecting higher lows. The resulting triangle points sideways. This pattern emerges when price action enters a period of indecision and trades within a tightening range, forming a classic price consolidation pattern. Both bulls and bears are engaged, but neither side is in full control.

You will notice this pattern in any liquid market—forex pairs like EURUSD, stocks such as Tesla, commodities like gold, and leading cryptocurrencies. As the triangle matures, the range between highs and lows gets smaller and smaller. Eventually, the pattern resolves with a decisive breakout trading move, where price escapes the triangle with force, often signalling the start of a new trend.

For instance, after an intense move up or down, a major asset might lose momentum and start forming lower highs and higher lows. As each swing gets smaller, traders can draw the triangle lines. The pattern becomes a visual representation of mounting pressure—a coiled spring waiting to explode.

The Psychology Behind the Pattern

Understanding the psychology of the symmetrical triangle pattern is vital. This formation reveals a “stalemate” in the market. Traders are unsure about the next direction. Both buyers and sellers gradually reduce the size of their bets. As the price range narrows, fewer traders are willing to take risks. This creates the classic price consolidation pattern, where volume often drops and volatility shrinks.

This tension builds until something forces the market to act—a news release, earnings announcement, central bank policy, or simply a shift in market sentiment. When that moment comes, one side gives up, leading to a surge of orders in the breakout direction. The result is a powerful breakout trading event, with price and volume surging together. The symmetrical triangle pattern ends, and a new trend often begins.

For example, before the release of US Nonfarm Payrolls data, the USDJPY might tighten into a clear triangle as traders wait. Once the news is released, the pattern typically ends with a sharp move, catching the attention of breakout trading specialists.

Identifying the Symmetrical Triangle Pattern

Spotting a symmetrical triangle pattern involves careful observation. Start by identifying a prior trend—up or down—or a period of strong price action. Next, look for a sequence of lower highs and higher lows. Draw a downward-sloping trendline over the highs and an upward-sloping trendline below the lows. The lines should visibly converge, enclosing the majority of the price action.

Pay close attention to the shape: the triangle should have symmetry, with neither the top nor bottom line flat. Volume should decline as the pattern matures. On the chart, candlesticks become smaller, and swings grow less dramatic. This visual “squeezing” is your clue that a price consolidation pattern is developing.

In real-world charts, patterns may not be perfect. A symmetrical triangle on the GBPUSD weekly chart might look cleaner than one on a fast-moving five-minute S&P 500 chart. Still, the principle is the same: lower highs, higher lows, converging trendlines, and a focus on the eventual breakout trading setup.

Why the Symmetrical Triangle Pattern Works

The symmetrical triangle pattern works because it highlights the natural ebb and flow of market sentiment. As the triangle forms, neither side is willing to commit big money. Price moves grow smaller, and liquidity dries up. This creates pent-up energy in the market.

Breakout trading is so effective here because all the waiting and indecision is resolved in a single, clear move. As soon as the triangle breaks—usually before the very tip—volume jumps, stop orders are triggered, and traders rush in to catch the new trend. This is why breakout trading strategies that focus on symmetrical triangles can be so profitable.

A great example comes from gold. After a big rally, gold sometimes moves sideways and forms a triangle. When the pattern finally breaks, the move is often sharp and lasting, producing reliable signals for traders watching for price consolidation patterns.

The Symmetrical Triangle Trading Strategy

A sound symmetrical triangle trading strategy is built around patience and discipline. Here’s how to execute the approach effectively:

- Pattern recognition: Wait for a clear, mature triangle to form. Don’t force trades on incomplete patterns.

- Confirmation: Only act when the price closes outside one of the trendlines. This confirms the breakout trading move.

- Volume check: Look for a rise in volume on the breakout. A move on low volume is less trustworthy.

- Entry and stop: Enter just after the breakout is confirmed. Place your stop loss outside the opposite side of the triangle.

- Target: Measure the widest part of the triangle and project that distance from the breakout point. This gives you a logical profit target.

Suppose you spot a triangle on the Ethereum daily chart. The widest part of the triangle is $200. If ETH breaks out at $3,000, your first target would be $3,200. This method keeps your trading systematic and helps avoid emotional decisions.

Examples Across Markets

The symmetrical triangle pattern is common across every major market:

- In forex, EURUSD or GBPJPY often form triangles before important economic data releases. A breakout after the triangle can move the market by 100 pips or more.

- In stocks, leading names like Apple or Tesla sometimes consolidate into triangles ahead of earnings. Once the result is out, price can surge in the breakout direction.

- In crypto, Bitcoin is famous for triangle patterns. Before big network events or after long rallies, BTC often forms a tight price consolidation pattern, leading to explosive breakouts.

- In commodities, oil and gold frequently form triangles during periods of uncertainty. After several weeks of narrowing price swings, a strong move often follows the breakout.

Each of these examples underscores how versatile and reliable the symmetrical triangle trading strategy can be for breakout trading.

Managing Risk and Avoiding Common Mistakes

Risk management is critical when trading the symmetrical triangle pattern. Always wait for confirmation—a candle close outside the triangle on strong volume. Never enter before the breakout, as false moves and “fakeouts” are common in periods of price consolidation.

Set your stop loss just beyond the trendline opposite the breakout. Don’t place it too close, or you’ll get stopped out on normal volatility. Use position sizing so that one loss doesn’t impact your account significantly.

Another common mistake is setting unrealistic profit targets. Use the width of the triangle as your guide, and be willing to take profits if the move stalls or reverses. Remember, not every triangle leads to a huge trend, but over time, disciplined breakout trading will pay off.

Advanced Techniques for Symmetrical Triangle Trading

Experienced traders often add extra layers to their symmetrical triangle trading strategy. One approach is to combine triangle breakouts with momentum indicators like RSI or MACD. If the indicator supports the breakout direction, confidence in the trade increases.

Some traders use the “retest” technique: after the breakout, wait for the price to return and test the broken trendline. If it holds as support (or resistance), this can provide a safer entry with a tighter stop.

Multi-timeframe analysis also helps. You might spot a triangle on the daily chart and use the hourly chart for precise entry. Some traders even automate the process, letting trading bots scan for triangles and alert them to breakout trading setups.

Backtesting is another advanced tactic. Review historical charts, spot triangles, and note the outcomes. Look for patterns—does the symmetrical triangle pattern work better on certain assets, sessions, or after major news? Build your confidence and refine your system.

The Role of Volume in Breakout Trading

Volume is a crucial confirmation tool in symmetrical triangle trading. As the pattern develops, volume should gradually decrease, reflecting the market’s indecision and lack of commitment. But at the breakout, look for a significant spike in volume. This surge indicates that traders are rushing into the market, adding power to the move.

A breakout without volume is a red flag. Sometimes price pokes outside the triangle, only to reverse quickly if there’s no commitment from buyers or sellers. Always use volume as a final check before entering a trade.

Symmetrical Triangle Pattern and Trading Technology

Algorithmic and AI trading systems love the symmetrical triangle pattern. Because the formation is clear and rule-based, it’s easy to program bots to scan for these setups and execute breakout trading strategies automatically. When a triangle appears on a popular forex pair or a large-cap stock, you can bet that trading algorithms are also watching for the same signals.

This means breakouts can happen fast and with force, as both human and algorithmic traders pile in. For discretionary traders, staying alert and ready to act is key.

Frequently Asked Questions

Can I use the symmetrical triangle pattern on all timeframes?

Yes. While it is most reliable on four-hour, daily, and weekly charts, many traders use it for intraday setups too.

What if the breakout fails?

Every pattern fails sometimes. That’s why stops are critical. If price returns inside the triangle after a breakout, exit and wait for the next setup.

Does this pattern work better in trending or range-bound markets?

The symmetrical triangle can form in both. Breakouts tend to be stronger when the pattern appears after a strong trend.

Is it possible to combine the pattern with other strategies?

Absolutely. Many traders pair triangles with support and resistance, Fibonacci retracements, or volume analysis for confirmation.

Final Thoughts

The symmetrical triangle pattern is a foundation of modern technical analysis. Its appearance signals a high-probability price consolidation pattern that can deliver strong breakout trading signals. By mastering how to spot this formation, waiting for confirmation, managing your risk, and staying disciplined, you can add a reliable tool to your trading arsenal.

Apply the symmetrical triangle trading strategy in your daily analysis. Backtest your ideas, combine them with other indicators if you wish, and most importantly, remain patient. With practice, the symmetrical triangle pattern can help you capture big moves and improve your trading results in any market.

Read here to learn more about “Double Top Pattern: Easy Signals and Winning Trading Strategies“.

I’m Chaitali Sethi, a financial writer and market strategist focused on Forex trading, market behaviour, and trader psychology. I simplify complex market movements into clear, practical insights that help traders make better decisions and build a stronger trading mindset.